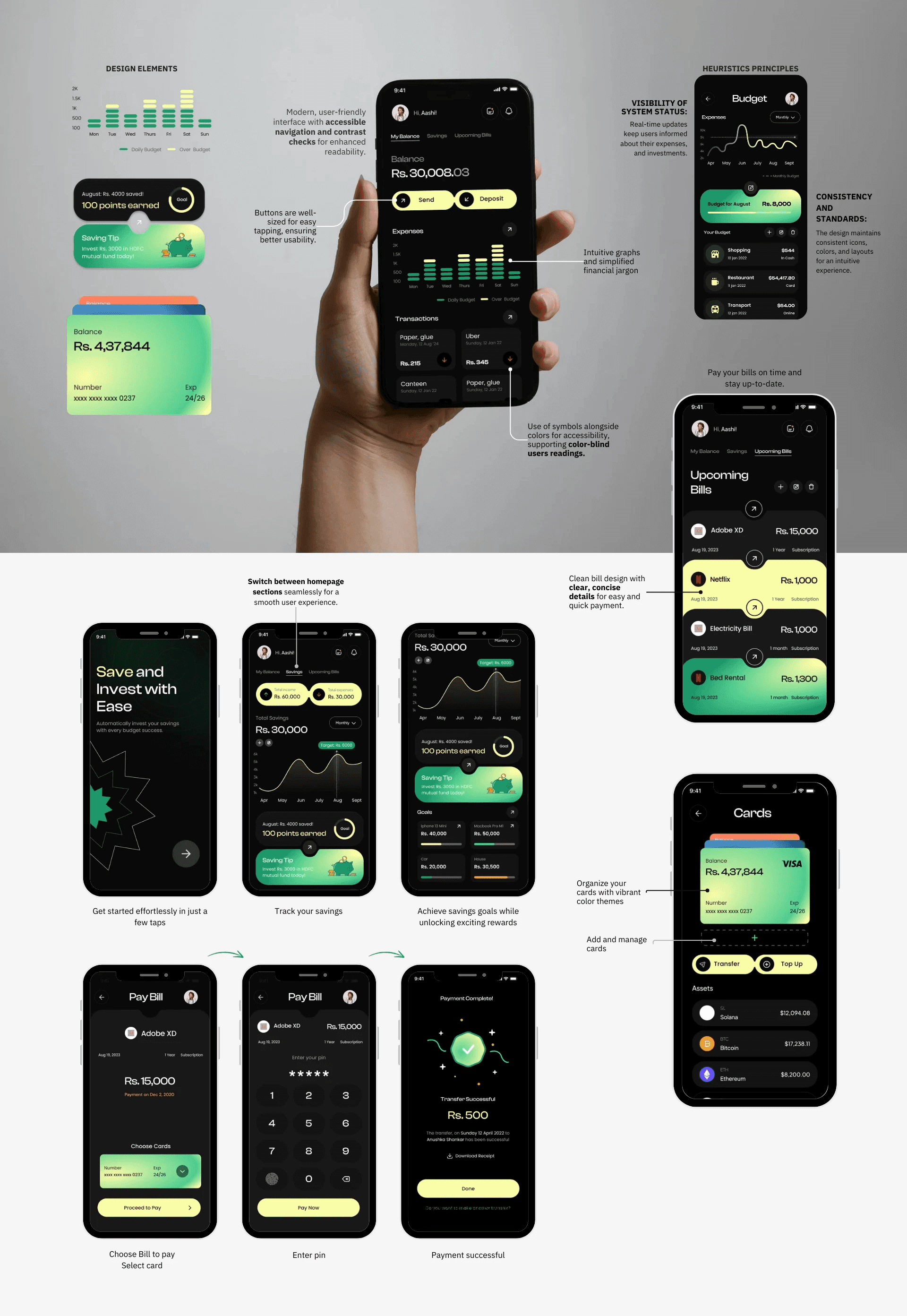

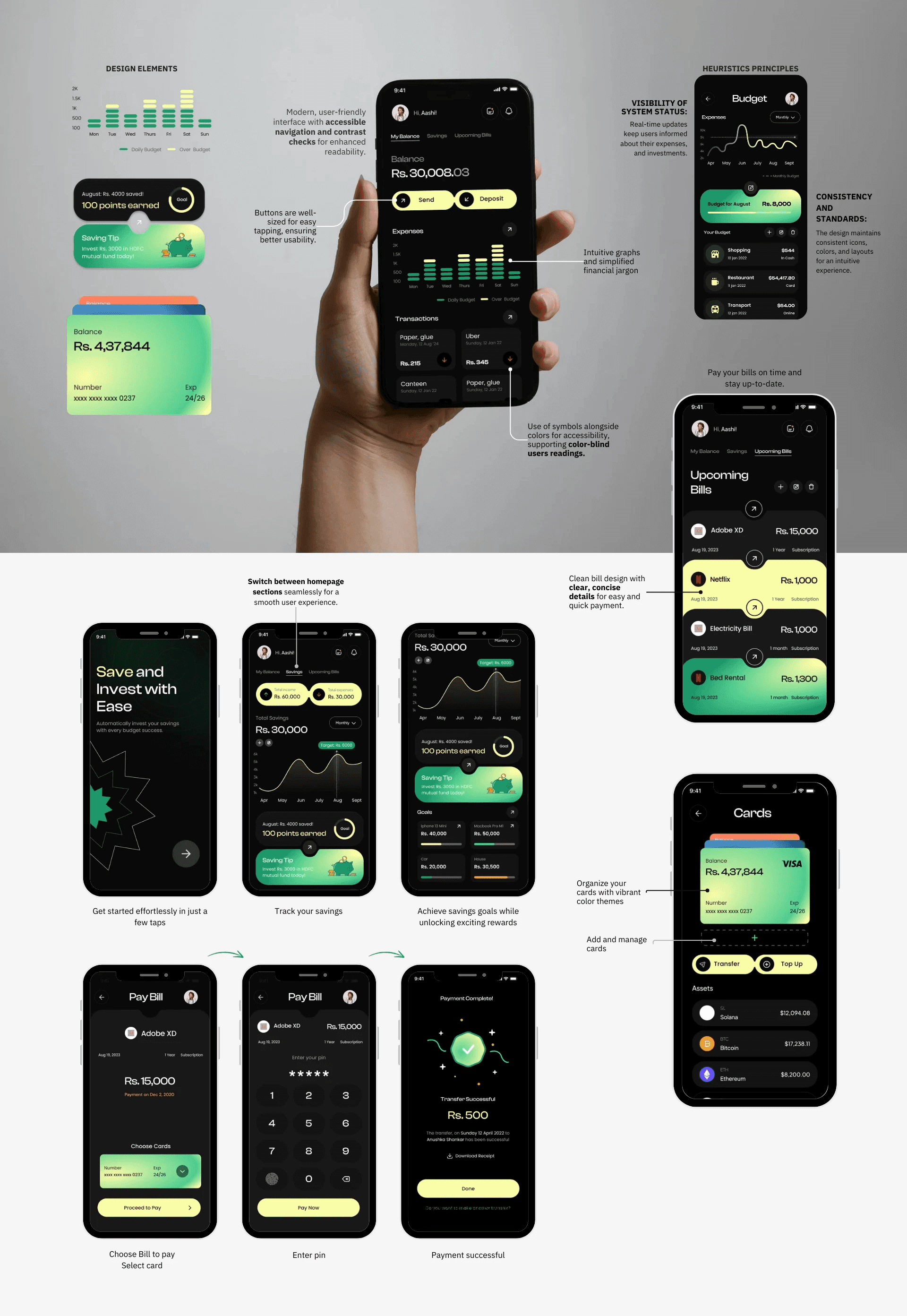

Expense management app

BatuaWise

BatuaWise

BatuaWise

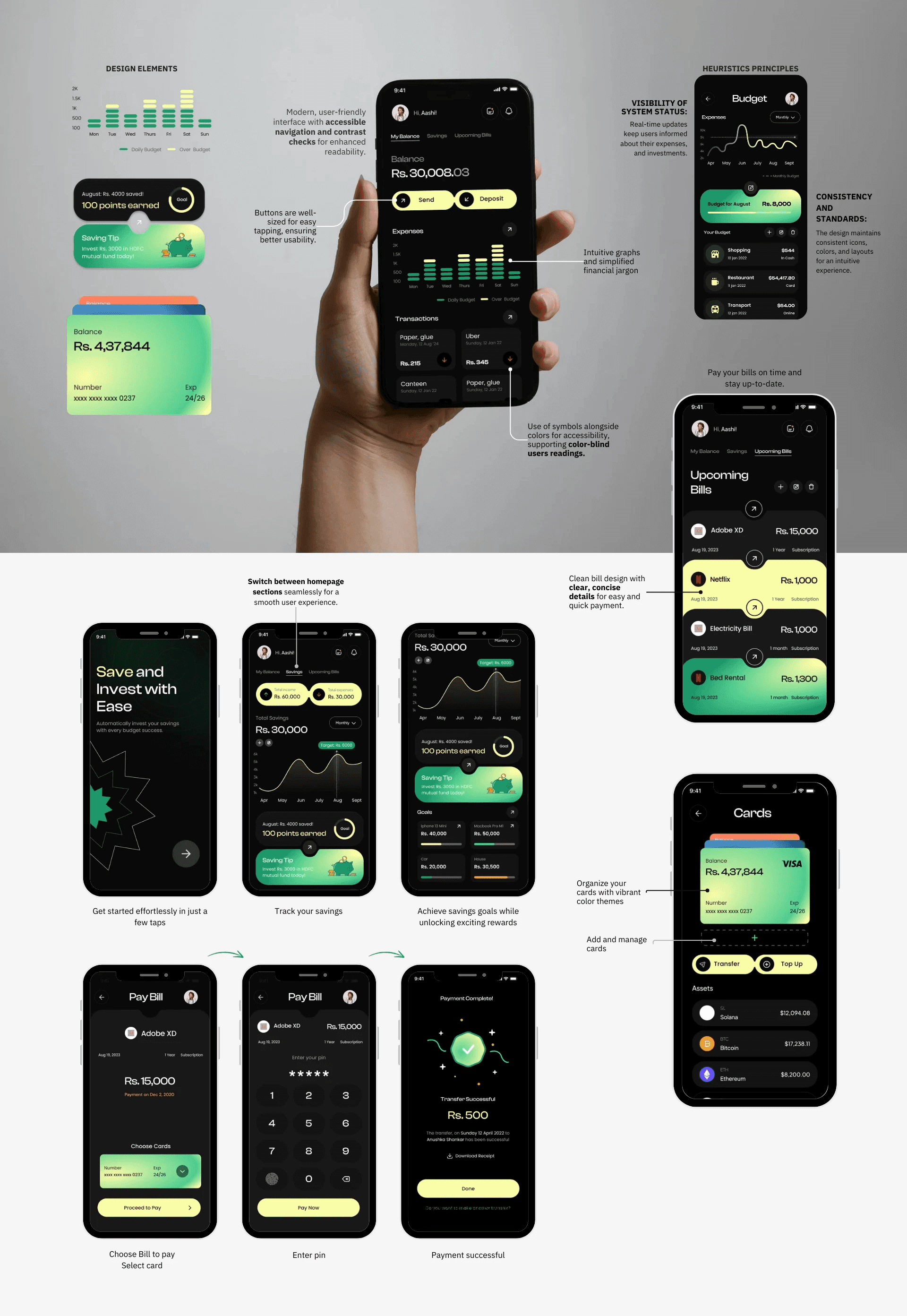

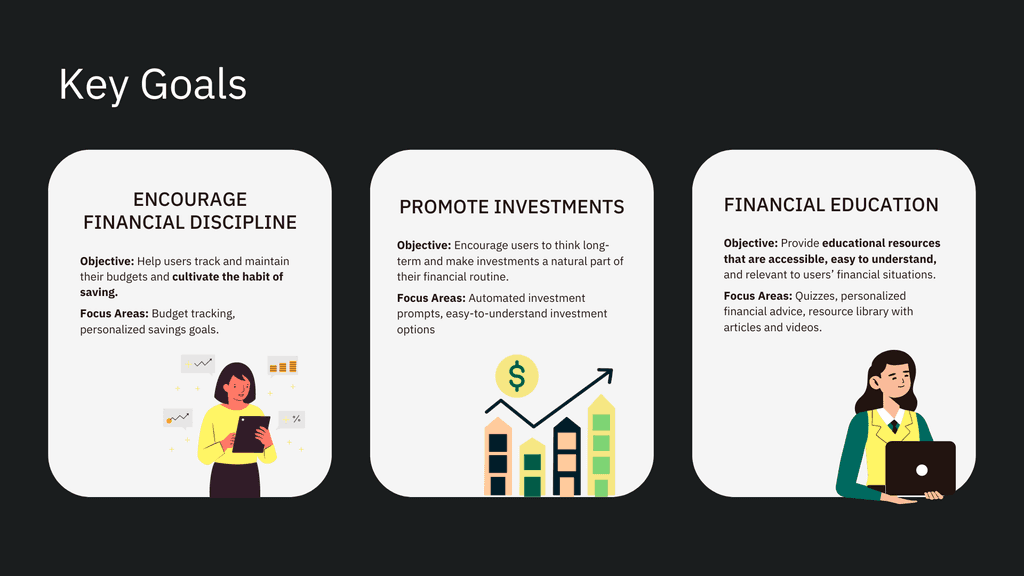

Introducing an expense management platform that helps users track spending and prompts smart investments whenever they save. The app also includes financial literacy features to educate users on investments and personal finance, promoting informed and responsible habits.

skills

Trend Research, Interface design, Prototyping

Trend Research, Interface design, Prototyping

DUration

5 Days

5 Days

5 Days

01

Problem Statement

Problem Statement

Problem Statement

92% of students

said NO when asked if universities and schools provide enough skills and knowledge to take wise financial decisions?

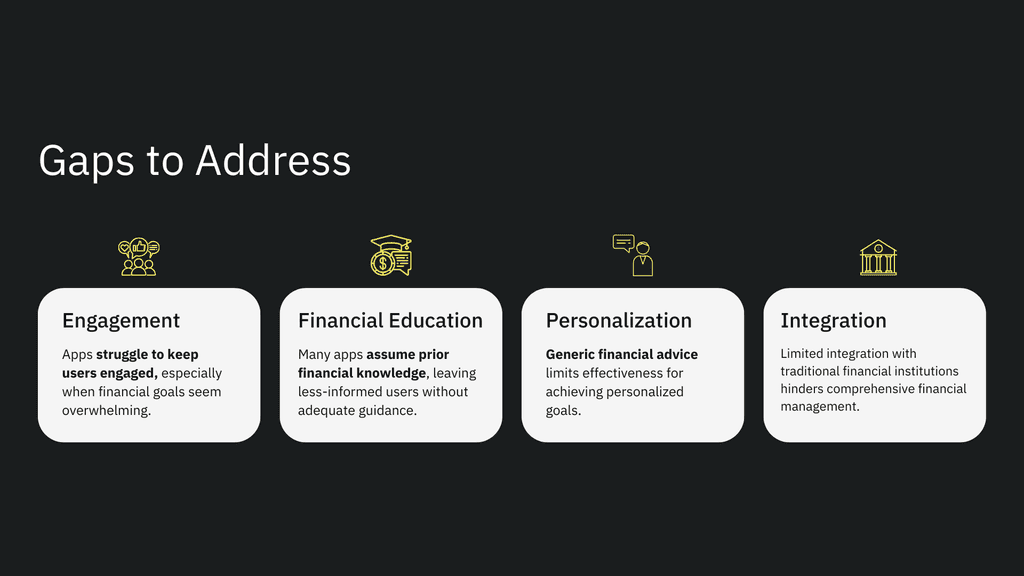

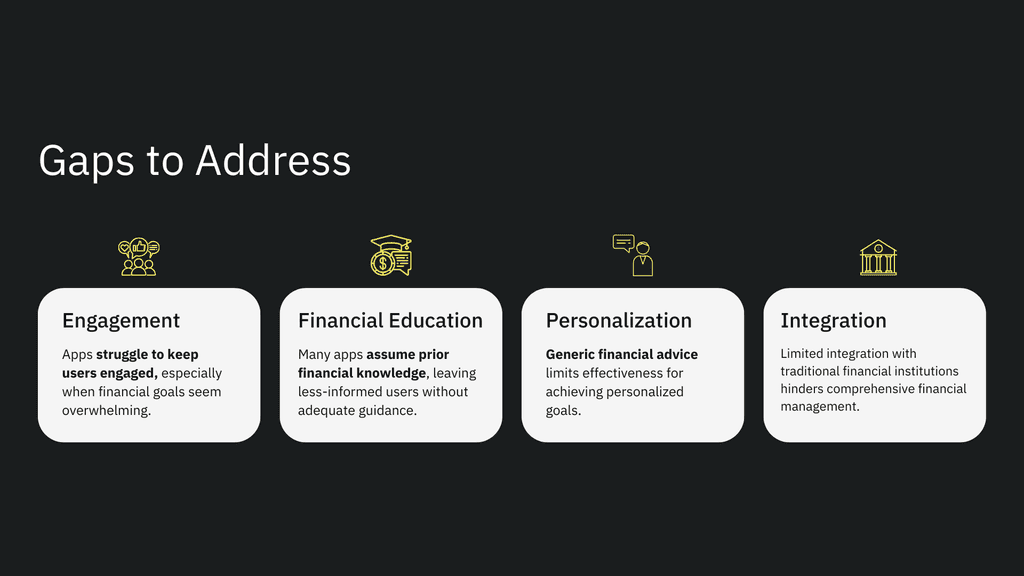

Many expense management apps have difficulty keeping users engaged, providing clear financial education, and offering personalized advice. They also struggle to integrate smoothly with traditional financial institutions, limiting their ability to help users meet their financial goals effectively.

92% of students

said NO when asked if universities and schools provide enough skills and knowledge to take wise financial decisions?

Many expense management apps have difficulty keeping users engaged, providing clear financial education, and offering personalized advice. They also struggle to integrate smoothly with traditional financial institutions, limiting their ability to help users meet their financial goals effectively.

92% of students

said NO when asked if universities and schools provide enough skills and knowledge to take wise financial decisions?

Many expense management apps have difficulty keeping users engaged, providing clear financial education, and offering personalized advice. They also struggle to integrate smoothly with traditional financial institutions, limiting their ability to help users meet their financial goals effectively.

The target audience is young professionals aged 21-35, including students, early/mid-career professionals, and freelancers. They are tech-savvy, financially aware but may lack investment knowledge or consistency. They prefer easy-to-use tools with clear guidance and actionable advice, focusing on improving financial health and increasing savings and investments.

The target audience is young professionals aged 21-35, including students, early/mid-career professionals, and freelancers. They are tech-savvy, financially aware but may lack investment knowledge or consistency. They prefer easy-to-use tools with clear guidance and actionable advice, focusing on improving financial health and increasing savings and investments.

The target audience is young professionals aged 21-35, including students, early/mid-career professionals, and freelancers. They are tech-savvy, financially aware but may lack investment knowledge or consistency. They prefer easy-to-use tools with clear guidance and actionable advice, focusing on improving financial health and increasing savings and investments.

03

Design Sprint Method

Design Sprint Method

03

Design Sprint Method

Design Sprint Method

03

Design Sprint Method

Design Sprint Method

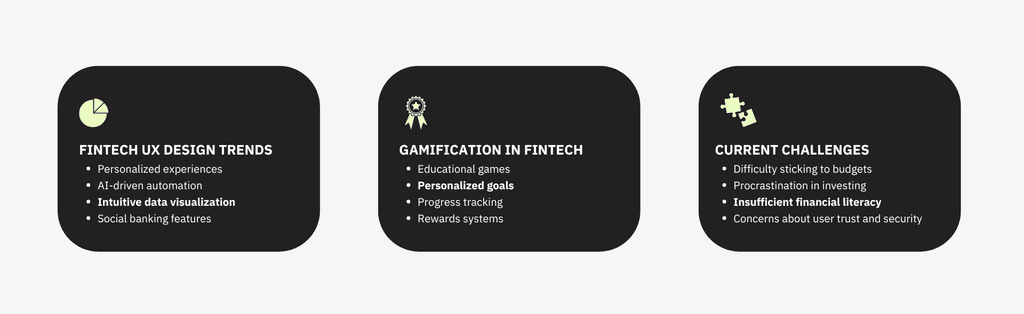

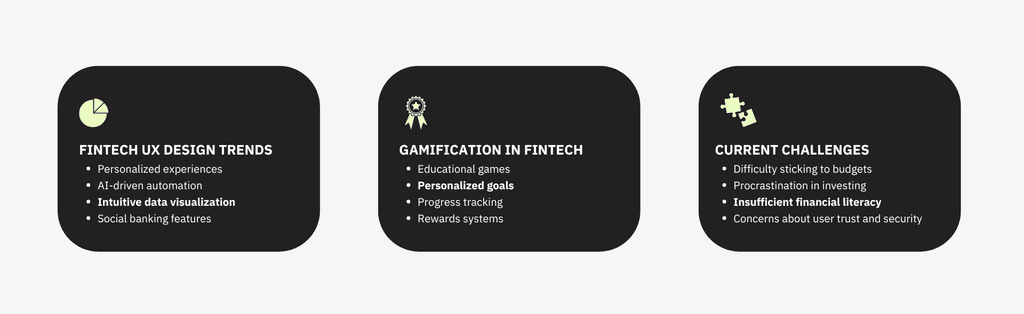

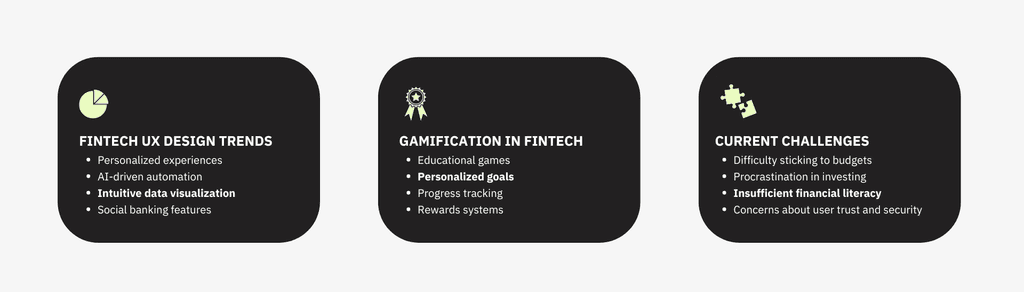

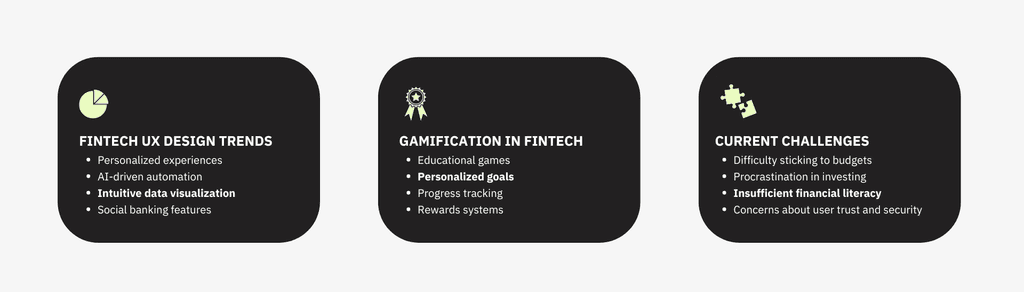

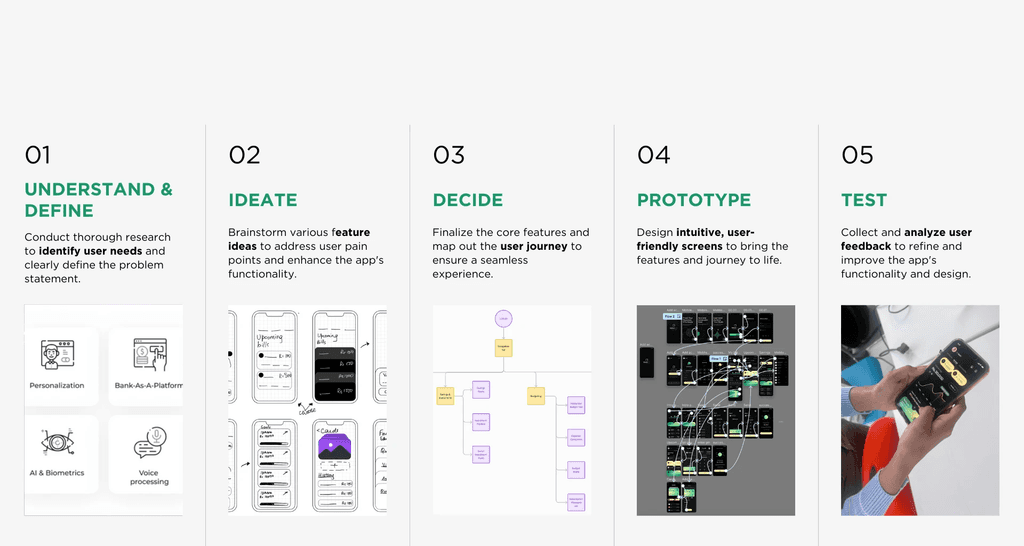

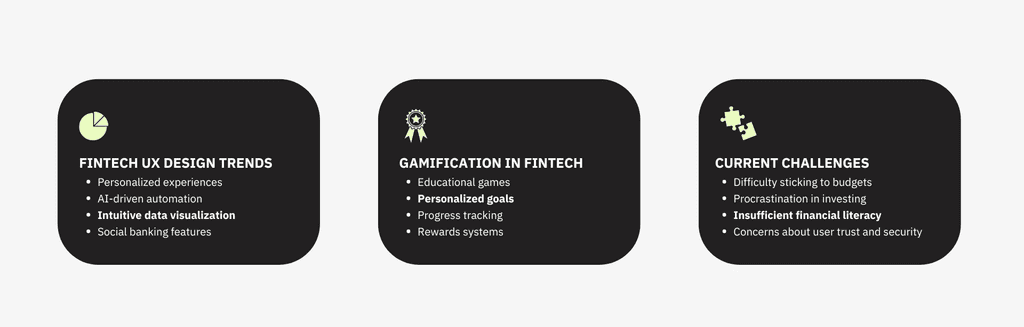

Researched fintech trends and studied market needs to identify user challenges.

How might we create an expense management platform that helps users track spending, encourages investing saved amounts, and includes financial literacy features to guide informed decisions and promote responsible financial habits.

Researched fintech trends and studied market needs to identify user challenges.

How might we create an expense management platform that helps users track spending, encourages investing saved amounts, and includes financial literacy features to guide informed decisions and promote responsible financial habits.

Researched fintech trends and studied market needs to identify user challenges.

How might we create an expense management platform that helps users track spending, encourages investing saved amounts, and includes financial literacy features to guide informed decisions and promote responsible financial habits.

DAY 02

Ideation

Ideation

Ideation

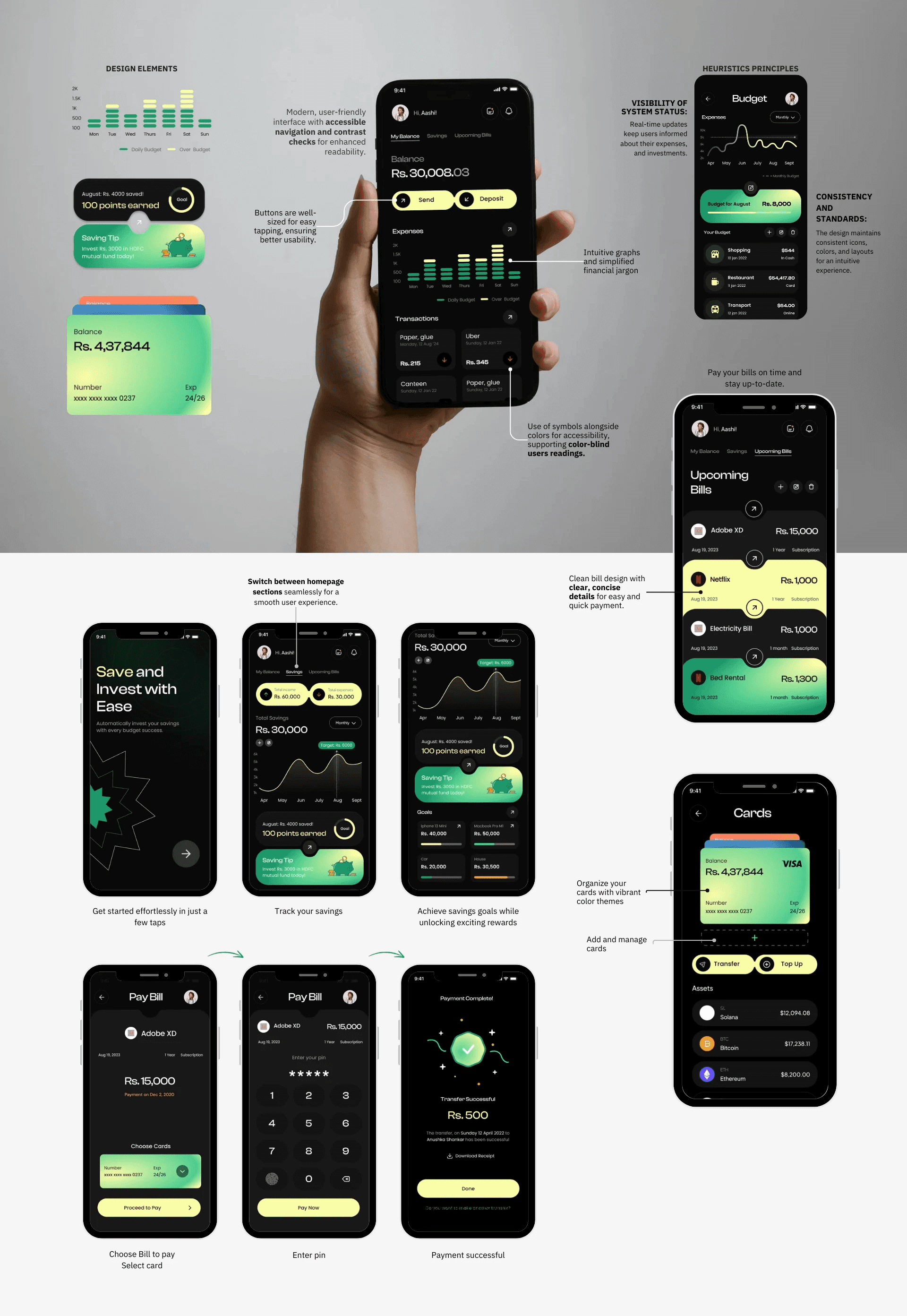

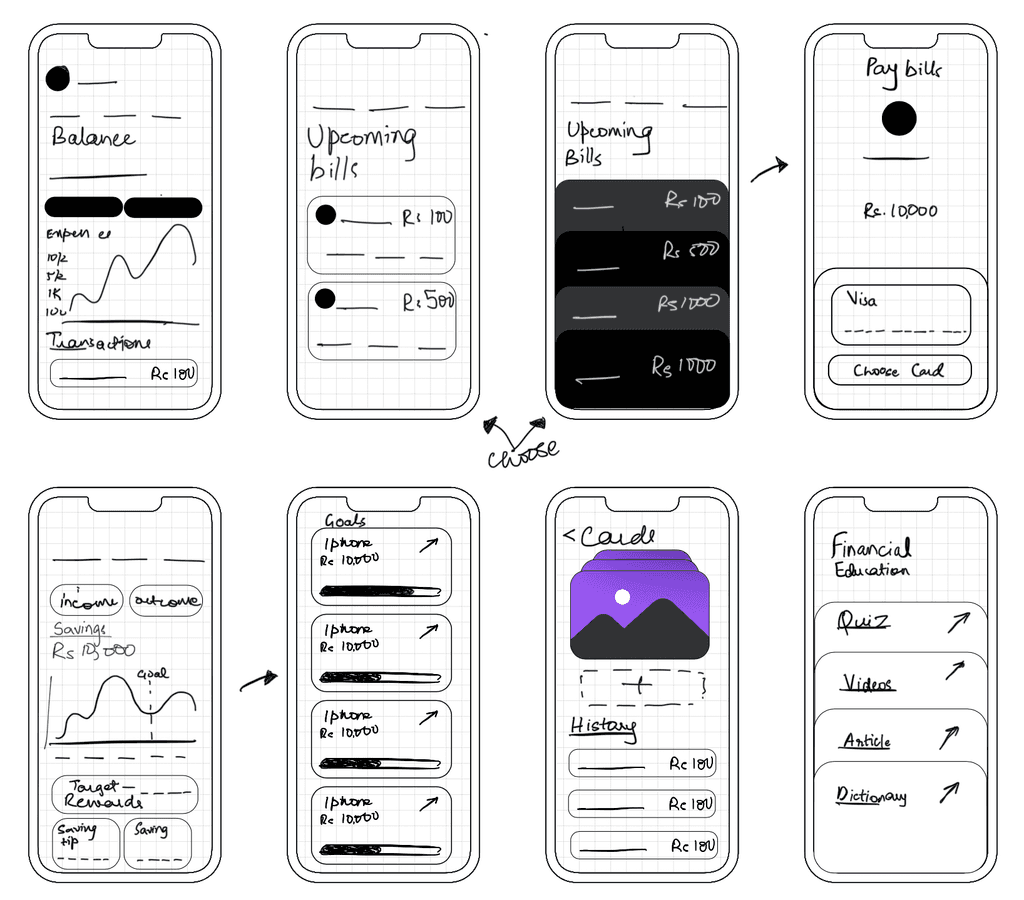

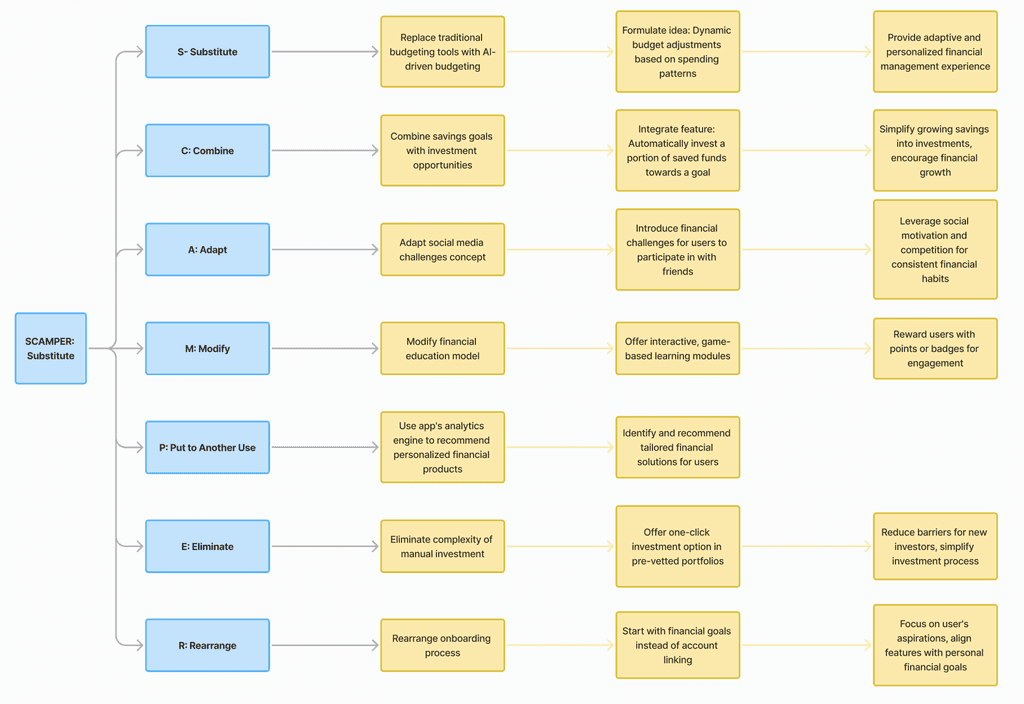

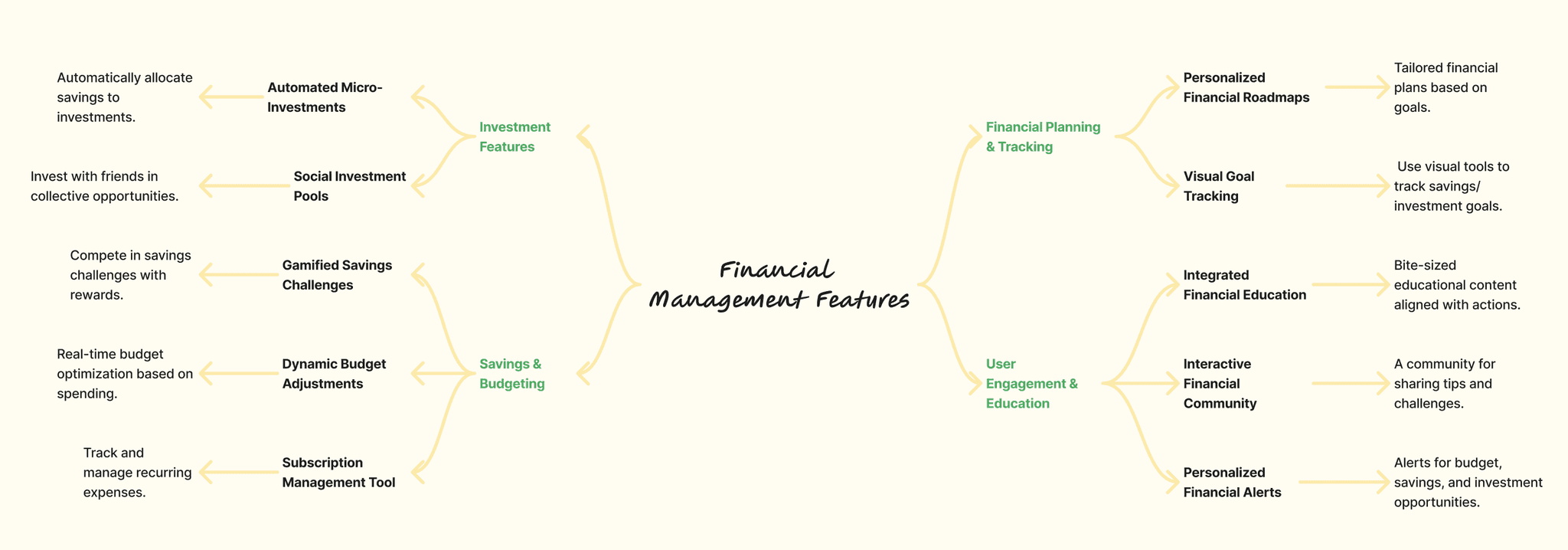

Used brainstorming techniques, the SCAMPER tool, and quick sketching to generate ideas for the app's features, focusing on enhancing user engagement and promoting savings and investments.

Used brainstorming techniques, the SCAMPER tool, and quick sketching to generate ideas for the app's features, focusing on enhancing user engagement and promoting savings and investments.

Used brainstorming techniques, the SCAMPER tool, and quick sketching to generate ideas for the app's features, focusing on enhancing user engagement and promoting savings and investments.

DAY 03

Decide

Decide

Decide

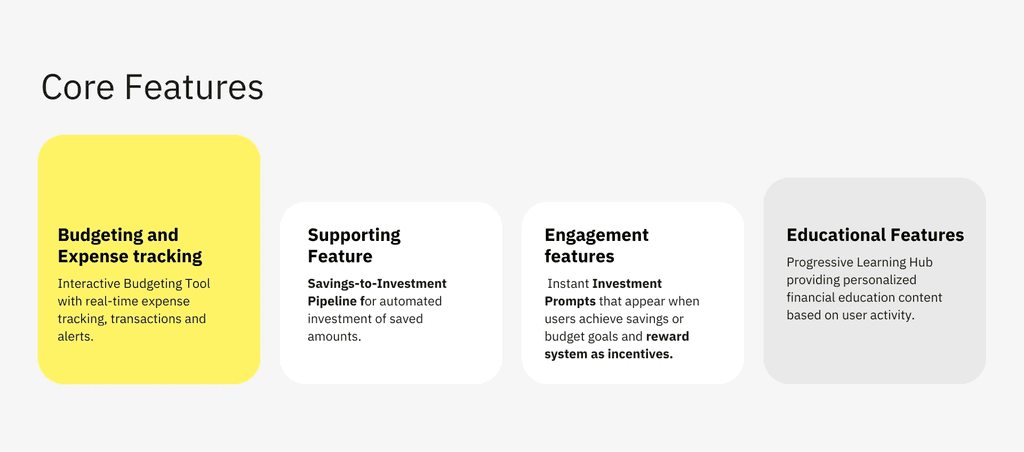

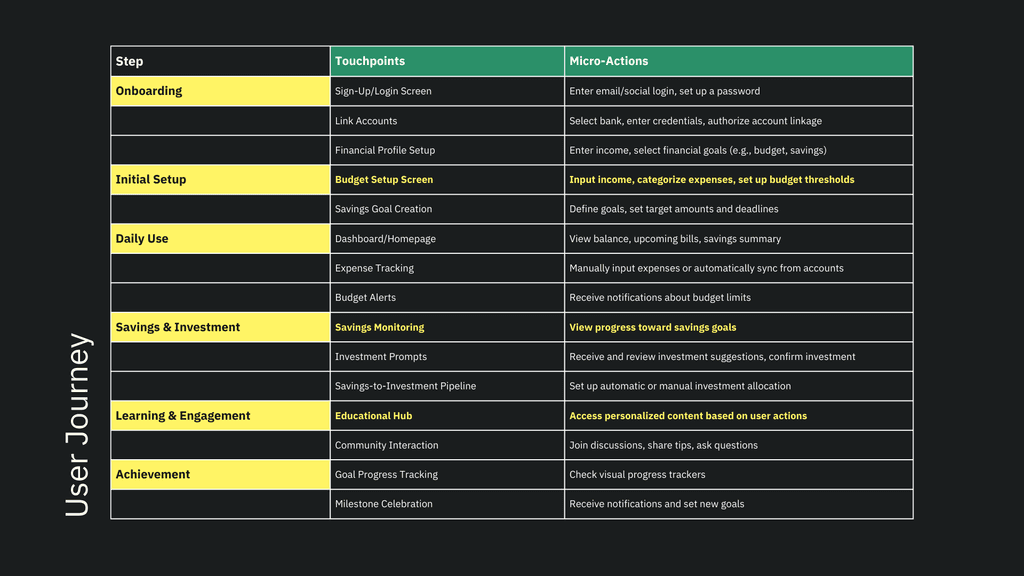

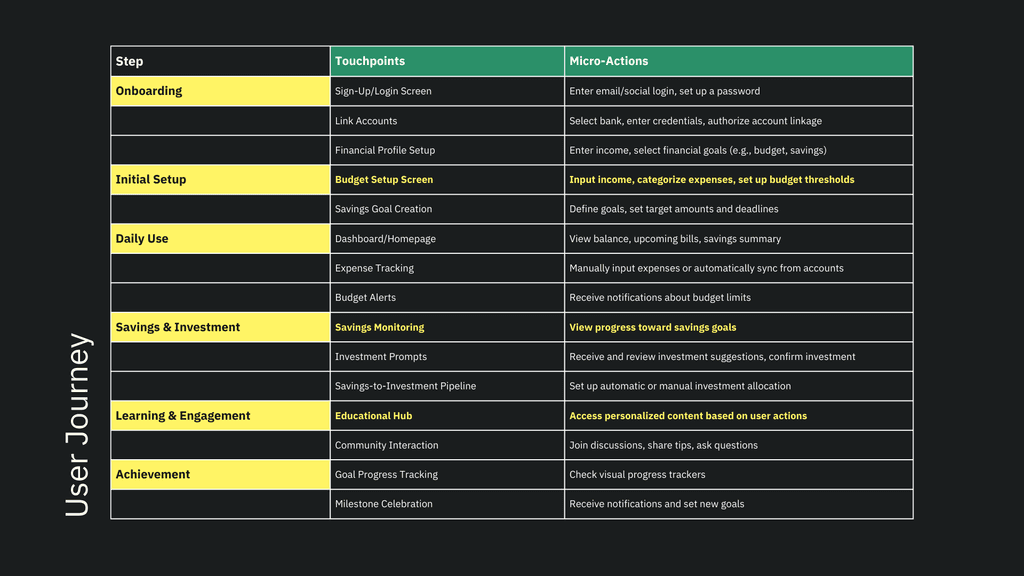

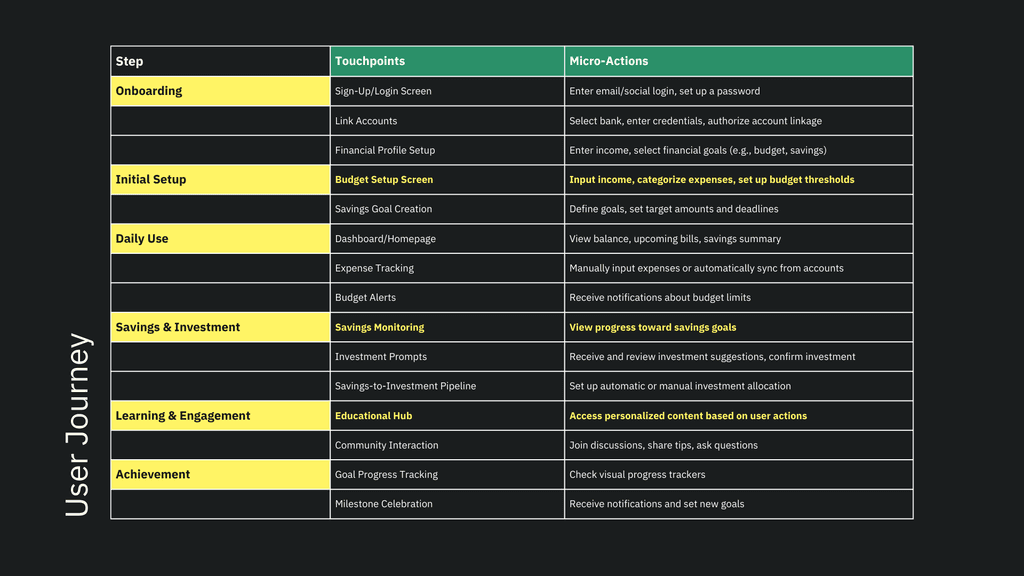

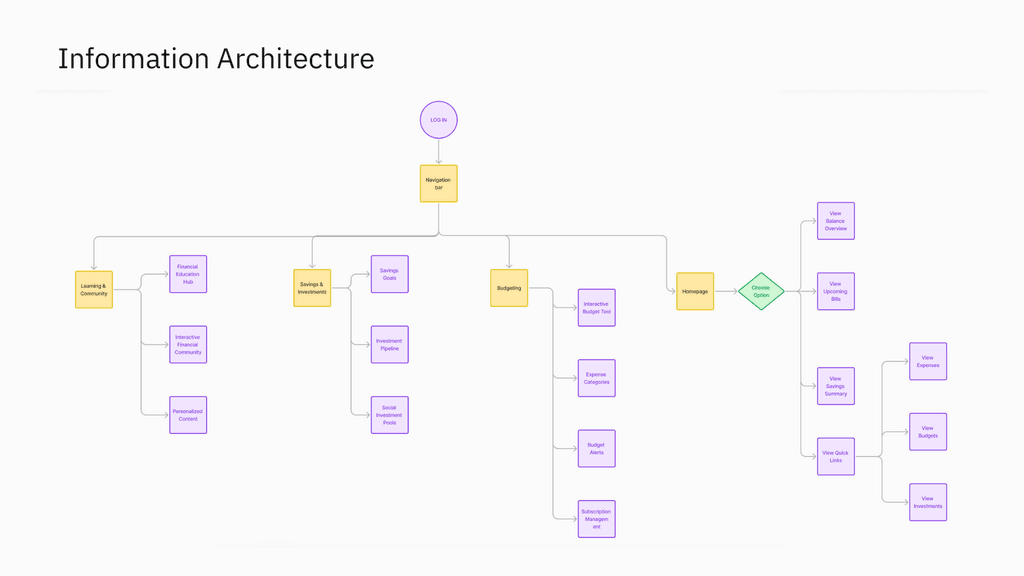

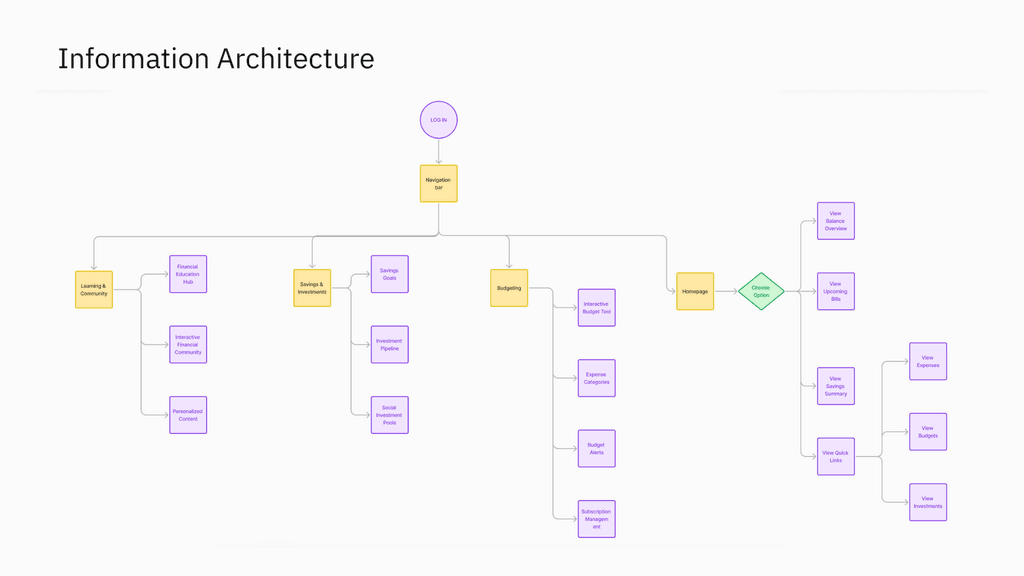

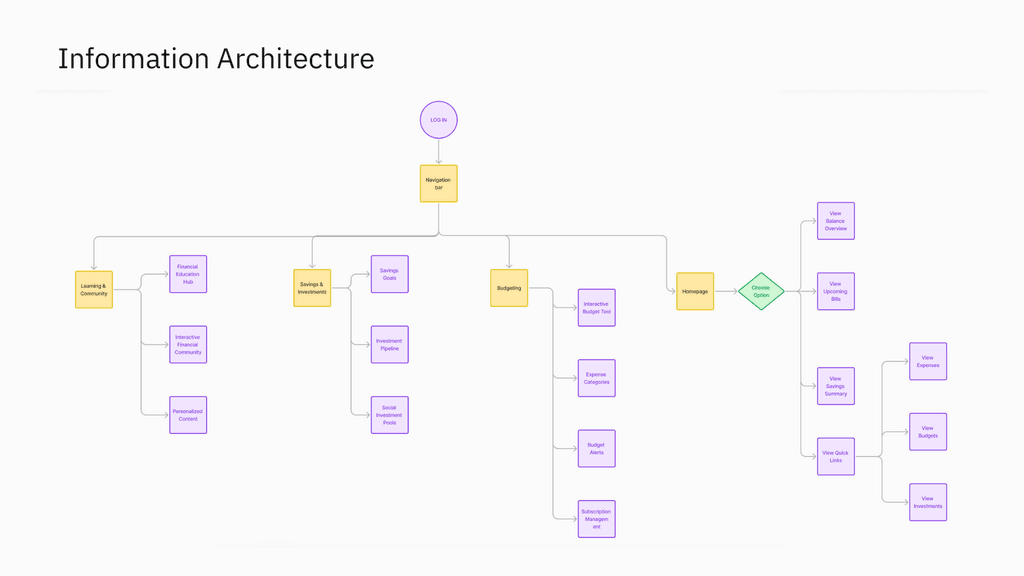

Make key decisions on which features and ideas to prioritize, refining the concept and mapping the user journey, focusing on creating an intuitive and engaging experience.

Make key decisions on which features and ideas to prioritize, refining the concept and mapping the user journey, focusing on creating an intuitive and engaging experience.

Make key decisions on which features and ideas to prioritize, refining the concept and mapping the user journey, focusing on creating an intuitive and engaging experience.

Built interactive screens focusing on core features like expense tracking, savings prompts, and personalized investment options. Designed a seamless, user-friendly experience to test functionality and flow.

Identify usability issues, compare feature effectiveness, and understand user preferences to refine the final product.